Dive Brief:

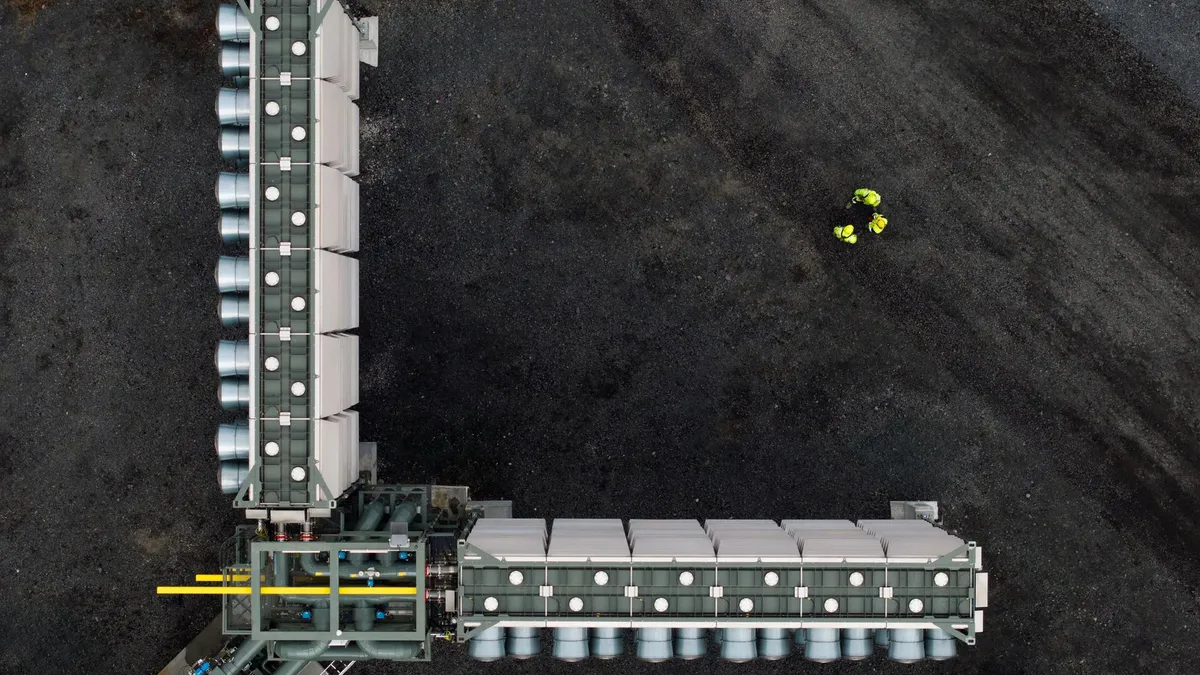

- Schneider Electric is purchasing 31,000 tons of carbon removal credits, to be delivered by 2039, from direct air capture company Climeworks, the companies announced Friday.

- Climeworks said the deal represents its largest portfolio agreement yet and Schneider Electric’s “first purchase of high durability carbon removal.” The carbon removals will be achieved through direct air capture and storage, renewable energy derived from biomass with carbon capture and storage and enhanced rock weathering.

- The deal will help support Schneider Electric’s corporate sustainability goals, which include reaching the company achieving carbon neutrality in its operational portfolio by 2025 and being “net-zero ready” across its operations by 2030. Schneider Electric also aims to reach net-zero emissions across its supply chain by 2050.

Dive Insight:

Schneider Electric’s 2030 “net-zero ready” goal will require it to reduce its scope 1 and scope 2 emissions by 90% by the end of the decade and utilize carbon removals to balance any residual direct emissions. The carbon removal credits issued from the direct air capture, bioenergy and enhanced rock weathering projects will help “neutralize a portion” of the French multinational electric and tech company’s residual emissions after it reaches its 2030 operational emissions reductions goal, according to Climeworks.

Schneider Electric Chief Sustainability Officer Esther Finidori said that the company’s foray into “durable” carbon removals complements its emissions reduction strategy and nature-based removal investment and diversifies the company’s removal portfolio.

“Both carbon removal and carbon reduction are fundamental to achieving our climate goals, as well as those of the planet,” Finidori said in Friday’s release. “Here’s an emerging industry, where early engagement catalyzes the scale-up of a wide range of technologies and supports the path for Schneider Electric and others in the future. ”

Finidori was appointed CSO in June, becoming Schneider’s second new CSO of 2025. Former sustainability chief Chris Leong started a short stint in the role in January, before taking a new dual role at Ecolab, which helps companies improve their environmental performance.

Schneider Electric’s 2025-2030 carbon removals strategy focuses on procuring high-quality, focused on matching the removals to where their emissions derive. The company’s net-zero strategy states that since the emissions it produces from burning fossil fuels come from the geosphere, it should “strive to procure carbon removals that are sequestered in the geosphere,” typically through engineered solutions.

“Initially, our carbon removals contribution portfolio will include a mix of nature based and engineered solutions, with a gradually increasing share of engineered solutions, as guided by science and regulation.” Schneider Electric’s net-zero strategy says. “The main reason for this gradual approach is the market maturity and availability.”

Climeworks said it is working to build “the world’s lowest-cost direct air capture technology” and the companies will collaborate on solutions to increase the process’ energy efficiency and reduce its cost.

The carbon removal company said that in order to scale DAC and bioenergy with carbon capture capabilities, additional funding is needed to help build the necessary infrastructure, which is capital expenditure intensive. Climeworks said refining measurement, reporting and verification is a priority to help scale and advance the enhanced rock weathering removal process.

Climeworks co-CEO Christoph Gebald called the deal a “milestone” for the company. “Demand for solutions that can store [carbon dioxide]permanently will only grow, making early access essential for forward-looking companies,” Gebald said in the release. “Our collaboration will not only help to further accelerate the cost-reduction trajectory of direct air capture, but also demonstrates that climate action and economic foresight go hand in hand—and carbon removal is where they meet.”

Climeworks’ deal with Schneider Electric adds to the DAC company’s client portfolio which also includes airlines British Airways, Swiss and Lufthansa, financial institution Morgan Stanley and the social media app TikTok.