NEW YORK — The terms “climate change,” “ESG” and “sustainability” have become highly politicized terms in recent years, landing in the fine print of contentious lawsuits, state-led probes and federal deregulation.

As a consequence, several companies and firms have increasingly steered away from publicizing their sustainability efforts. Many in the financial industry have gone a step further and withdrawn from climate alliances amid ongoing political scrutiny.

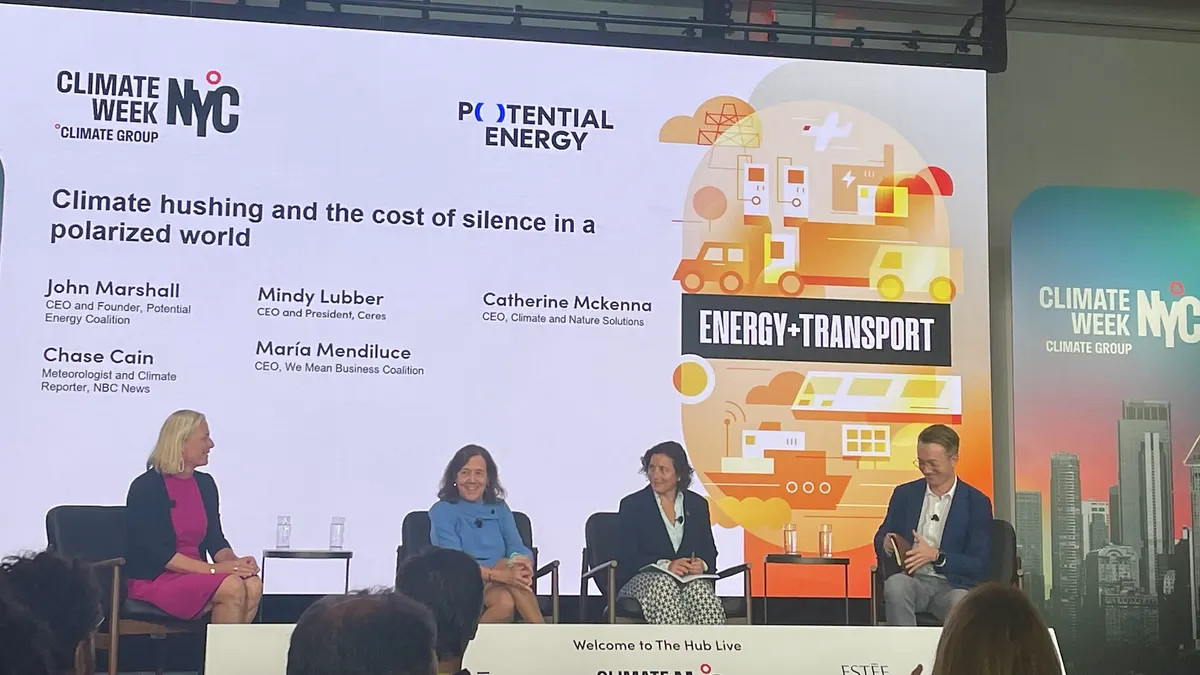

This shift was at the center of a Sept. 22 panel discussion that took place during New York City’s annual climate week, where senior executives from climate nonprofits and advisory firms unpacked the impact of “climate hushing” or “greenhushing.” The terms describe the act of companies deliberately downplaying, concealing or refraining from publicly announcing their progress on climate goals to safeguard themselves from potential criticism or backlash.

Mindy Lubber, CEO of environmental nonprofit Ceres, said she believes the companies who were advocates of setting corporate sustainability goals — especially those not in favor of President Donald Trump pulling out of the Paris Agreement again — are “still acting on climate change with a little bit less energy.”

“They still know they have to act, but they just don’t want to talk about it,” Lubber said. “The common knowledge is, ‘I don’t want a target on my back.’ That’s the problem.”

Lubber added that, given the current political climate, many U.S.-based companies are operating under the “fear that somebody is going to retaliate against them.”

Banks and financial institutions, in particular, have been the target of several state and federal Republican-led investigations as of late. Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo — all six of whom were previously part of the United Nations-backed Net-Zero Banking Alliance — were subject to separate probes initiated by 14 Republican state attorneys general and 12 Republican heads of agriculture in the past two years.

Separately, members of the U.S.-based Climate Action 100+ group have faced a whirlwind of investigations from House Republicans over their alleged use of environmental, social and governance factors in investment decisions.

Experts previously told ESG Dive Trump’s return to the White House, bolstered by a Republican majority in both the House and Senate to boost his legislative agenda, has created an overall atmosphere of fear and uncertainty that most financial institutions want to steer away from.

The Ceres CEO echoed the sentiment in last week’s panel: “I don't think any of those companies or anyone else believes climate change has gone away. They're just afraid to talk about it, because we're [living] in a climate of retaliation right now.”

Maria Mendiluce, CEO of decarbonization initiative the We Mean Business Coalition, added that in addition to protecting themselves from political scrutiny, some companies have resorted to greenhushing in fear of being potentially accused of greenwashing or making false environmental progress claims.

“Sometimes, companies that have been talking about the progress they have made might be accused of greenwashing,” Mendiluce said. “So, they say, ‘Okay, we are doing our best, but we are still being scrutinized.”

A 2024 report from ESG data and research firm RepRisk found that while overall greenwashing cases dipped between June 2023 and June 2024, the number of high-severity cases rose by 30%, with U.S. cases seeing a slight increase over the year after previously showing a brief downward trend.

RepRisk Chief Commercial Officer Alexandra Mihailescu Cichon told ESG Dive at the time that companies were being more cautious about how they communicate about their environmental claims specifically, but also about their ESG efforts more broadly, in part due to the “global undercurrent of greenhushing."

However, Lubber said — despite the political environment — the majority of businesses and investors are analyzing climate risk and acting on it as “a logical step for any rational business.”

“There's a reason 90% of CFOs say, ‘We are staying the course. We're going to spend more on climate and sustainability next year than we did last year,’” she added.